Longitudinal Growth Modeling Options

pcvr v0.1.0

Josh Sumner, DDPSC Data Science Core Facility

2026-02-13

Source:vignettes/longitudinal.Rmd

longitudinal.Rmd

library(pcvr)

library(data.table) # for fread

library(ggplot2)

library(patchwork) # for easy ggplot manipulation/combination

library(brms)Why Longitudinal Modeling?

Longitudinal modeling allows users to take full advantage of accurate and non-destructive data collection possible through high throughput image based phenotyping. Using longitudinal data accurately requires some understanding of the statistical challenges associated with it. Statistical complications including changes in variance (heteroskedasticity), non-linearity, and autocorrelation (plant’s day to day self similarity) present potential problems in analyses. To address this kind of data several functions are provided to make fitting appropriate growth models more straightforward.

Installation for Advanced Models

The brms package is not automatically imported by

pcvr, so before fitting brms models we need to

load that package. For details on installing brms and

either rstan or cmdstanr (with

cmdstanr being recommended), see the linked documentation.

Note that if you install pcvr from github with

dependencies=T then cmdstanr and

brms will be installed.

Once cmdstanr is installed we also need to set the

cmdstan path and link cmdstan to R, which is all done easily by

cmdstanr. For example, packages can be installed and

prepped using this code.

if (!"cmdstanr" %in% installed.packages()) {

install.packages("cmdstanr", repos = c("https://mc-stan.org/r-packages/", getOption("repos")))

}

if (!"brms" %in% installed.packages()) {

install.packages("brms")

}

library(brms)

library(cmdstanr)

cmdstanr::install_cmdstan()Available Growth Models

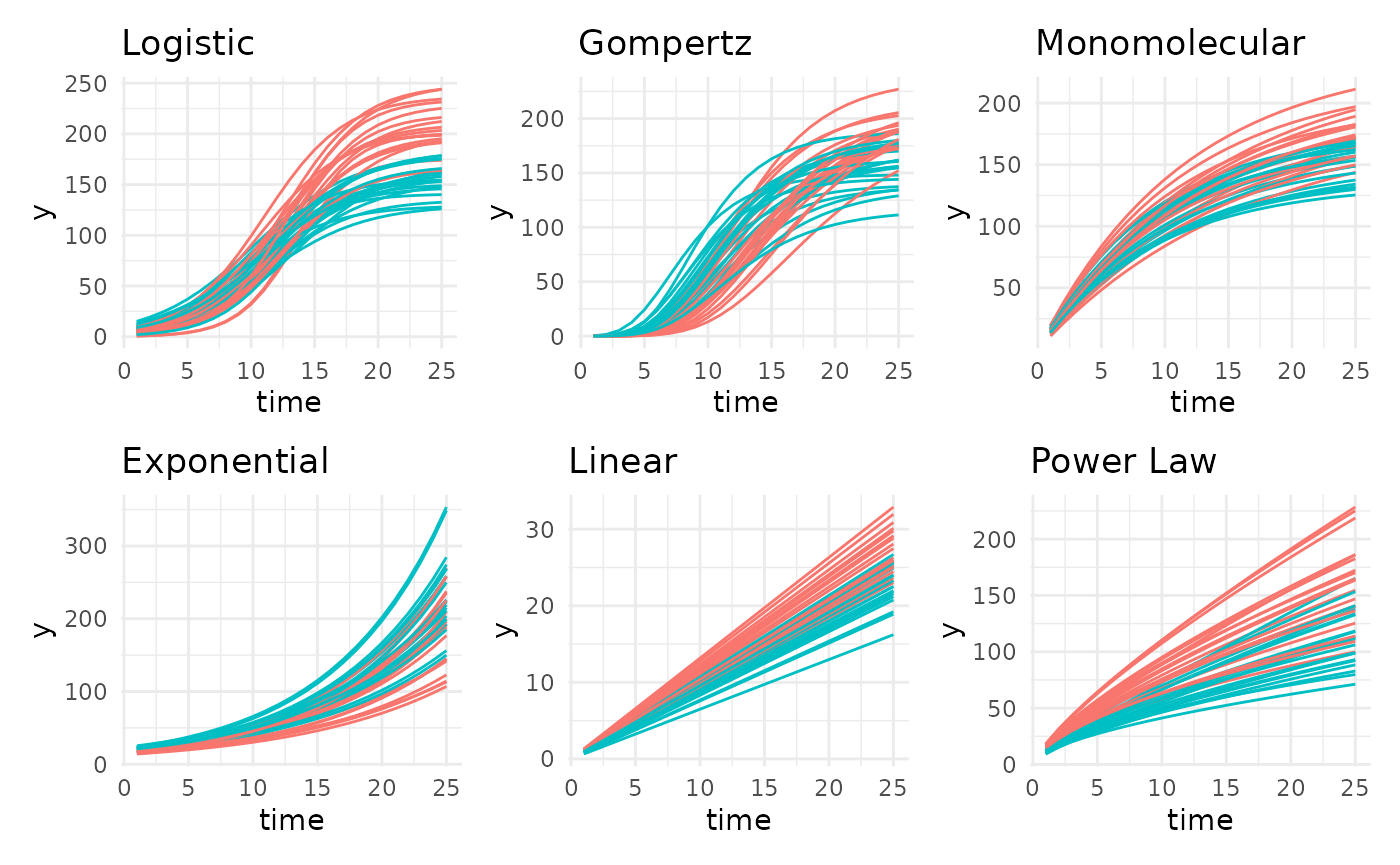

Based on literature and experience there are six common plant growth

models that make up the “main” models in growthSS, although

13 are supported. Those main six growth models are supported in

pcvr across each of four available backend functions

(nls, nlrq, nlme, and

brms). The mgcv backend can also be used to

fit generalized additive models (GAMS) to any of these growth curves as

well. In addition to these six main models GAMs, double logistic, and

double gompertz models are supported across the four available parameter

based backends. The parameterizations of these models are explained

below.

Logistic

The logistic function here is implemented as a 3 parameter sigmoidal growth curve:

In this model A is the asymptote, B is the inflection point, and C is the growth rate.

Gompertz

The gompertz function here is also a 3 parameter sigmoidal growth curve:

In this model A is the asymptote, B is the inflection point, and C is the growth rate.

The gompertz formula is more complex than the logistic formula, which tends to make the model slightly harder to fit in terms of time and computation. The benefit to that extra effort is that the gompertz curve is more flexible than the logistic curve and does not have to stop growing at the same rate as it initially started growing. In the author’s experience gompertz growth models have provided the best fit to sigmoidal data, but sometimes the speed and familiarity of the logistic function may be compelling.

Monomolecular

The monomolecular function here is a 2 parameter asymptotic growth curve:

Once again, A is the asymptote but now B is the growth rate.

This model has often fit well for height or width phenotypes, but you should make model choices based on your data/expectations.

Exponential

The exponential function here is a 2 parameter non-asymptotic growth curve bearing strong similarity to the monomolecular formula:

Here A is a scale parameter and B is the growth rate.

Most plants do not grow indefinitely, although many may grow

exponentially through the course of an experiment (think of the first

half of a logistic or gompertz curve). In those cases you may wish to

use an exponential model or if you are using the brms

backend then you may wish to rely on some prior information about an

asymptote that would eventually be achieved to use a sigmoidal

model.

Power Law

The power law function here is a 2 parameter non-asymptotic growth curve:

Here A is a scale parameter and B is the growth rate. The formula becomes linear when B is 1, shows slowing growth over time when 0 < B < 1 and shows growth speed increasing over time (the exponential) when B > 1.

These models can allow for slowing growth over time but without the expectation that growth ever truly stops.

Linear

The linear function here is simply:

Here A is the growth rate and the intercept is assumed to be 0.

Double Logistic

The double logistic function here is just two combined logistic functions:

Here the parameters have the same interpretation as those in the logistic curve, but for the first and second component separately.

This is intended for use with recover experiments, not for any data

with very minor hiccups in the overall trend. Additionally, with the

brms backend the segmented models allow for a more flexible

implementation as logistic+logistic, although in that

implementation the values for A and B are not relative.

Double Gompertz

The double logistic function here is just two combined gompertz functions:

Here the parameters have the same interpretation as those in the gompertz curve, but for the first and second component separately.

All the same points as with the double logistic curve apply here as well.

Weibull

The weibull growth curve is derived from the generalized extreme value distribution and is comparable to the gompertz growth model option, but may be slightly easier to fit/faster moving in some cases.

Gumbel

The gumbel growth curve is also derived from the generalized EVD and would be used in similar contexts as the weibull or gompertz model options. The choice of which to use is left to individual users and the conventions of your field.

Frechet

This is the final option derived from the generalized EVD. Note that here a 3 parameter version is used with the location (m) set to 0 by default.

Bragg

The Bragg model is a dose-response curve that models the minima and maxima using 3 parameters.

Lorentz

The Lorentz model is a dose-response curve that models the minima and maxima using 3 parameters. This parameterization may has a slightly more intuitive formula than Bragg for some people but has worse statistical qualities.

Beta

The Beta model is based on the PDF of the beta distribution and models minima/maxima as a dose-response curve using 5 parameters. This can be a difficult model to fit but can describe non-symmetric dose-response relationships well.

GAM

Finally, all backends can fit GAMs. These are unparameterized functions that use a series of splines to fit a variety of trends.

In general these are less useful since they do not give directly interpretable parameters, but their flexibility can be valuable if your data does not fit some more standard model well.

Simulating data

Data from any parameterized model can be simulated using

growthSim. Through this vignette we will use data created

in this way to show modeling options.

simdf <- growthSim("logistic", n = 20, t = 25, params = list(

"A" = c(200, 160),

"B" = c(13, 11),

"C" = c(3, 3.5)

))

l <- ggplot(simdf, aes(time, y, group = interaction(group, id))) +

geom_line(aes(color = group)) +

labs(title = "Logistic") +

theme_minimal() +

theme(legend.position = "none")

simdf <- growthSim("gompertz", n = 20, t = 25, params = list(

"A" = c(200, 160),

"B" = c(13, 11),

"C" = c(0.2, 0.25)

))

g <- ggplot(simdf, aes(time, y, group = interaction(group, id))) +

geom_line(aes(color = group)) +

labs(title = "Gompertz") +

theme_minimal() +

theme(legend.position = "none")

simdf <- growthSim("monomolecular", n = 20, t = 25, params = list("A" = c(200, 160), "B" = c(0.08, 0.1)))

m <- ggplot(simdf, aes(time, y, group = interaction(group, id))) +

geom_line(aes(color = group)) +

labs(title = "Monomolecular") +

theme_minimal() +

theme(legend.position = "none")

simdf <- growthSim("exponential", n = 20, t = 25, params = list("A" = c(15, 20), "B" = c(0.095, 0.095)))

e <- ggplot(simdf, aes(time, y, group = interaction(group, id))) +

geom_line(aes(color = group)) +

labs(title = "Exponential") +

theme_minimal() +

theme(legend.position = "none")

simdf <- growthSim("linear", n = 20, t = 25, params = list("A" = c(1.1, 0.95)))

ln <- ggplot(simdf, aes(time, y, group = interaction(group, id))) +

geom_line(aes(color = group)) +

labs(title = "Linear") +

theme_minimal() +

theme(legend.position = "none")

simdf <- growthSim("power law", n = 20, t = 25, params = list("A" = c(16, 11), "B" = c(0.75, 0.7)))

pl <- ggplot(simdf, aes(time, y, group = interaction(group, id))) +

geom_line(aes(color = group)) +

labs(title = "Power Law") +

theme_minimal() +

theme(legend.position = "none")

patch <- (l + g + m) / (e + ln + pl)

patch

Available Model Backends

As previously mentioned there are five backends supported in

pcvr. Here we will go over those backends in more detail.

These backends are selected using one of nls, nlrq, nlme, mgcv, or brms

which correspond to the functions shown in this table.

| “nls” | “nlrq” | “nlme” | “mgcv” | “brms” |

|---|---|---|---|---|

stats::nls |

quantreg::nlrq |

nlme::nlme |

mgcv::gam |

brms::brms |

nls

The nls backend is the simplest option. These models

account for non-linearity using any of the aforementioned model types

and fit very quickly but do not have ways to take autocorrelation or

heteroskedasticity into account.

nlrq

The nlrq backend fits non-linear quantile models to

specified quantiles of the data. These models account for non-linearity

and account for heteroskedasticity in a non-parametric quantile based

way (fitting 2.5% and 97.5% models will provide something like a 95%

confidence interval that changes width across time as the data

does).

nlme

The nlme backend fits non-linear mixed effect models.

These models account for non-linearity, autocorrelation, and to have

options to model the heteroskedasticity.

mgcv

The mgcv backend only fits GAMs, which do account for

non-linearity but do not account for heteroskedasticity and

autocorrelation and do not return interpretable parameters.

brms

The brms backend fits hierarchical Bayesian models that

account for non-linearity, autocorrelation and heteroskedasticity. These

models are more flexible than any of the other options and are the focus

of the Advanced

Growth Modeling Tutorial.

Making models in pcvr

At a high level the relevant functions in pcvr are

growthSS, fitGrowth, growthPlot,

and testGrowth.

growthSSspecifies self starting growth models and returns a list that is used byfitGrowthfitGrowthfits a growth model specified bygrowthSSand returns a model or a list of model options.growthPlotvisualizes the model fit. This is particularly helpful withbrmsmodels to check their heteroskedastic sub models.testGrowthtests model parameters against nested versions of the same models to allow for straightforward hypothesis testing on frequentist (non-brms) models. Forbrmsmodels thebrms::hypothesisfunction should be used.

Using growthSS

growthSS is the first pcvr helper function

for setting up longitudinal models. growthSS will return a

list of elements used to fit a longitudinal model including a formula,

starting values (or priors for brms values), data to use,

and several elements used internally in other functions.

growthSS takes five arguments which specify the model to

use, a simplified formula specifying the columns of your data to use, a

sigma option, the data to use, and starting values/priors. The model and

data to use are relatively straightforward, compare a plot of your data

against the general shapes of the model parameterizations shown above to

pick a model type and pass your dataframe to the df

argument. The remaining arguments are explained below.

growthSS(..., form, ...)

The form argument of growthSS needs to

specify the outcome variable, the time variable, an identifier for

individuals, and the grouping structure. These are passed as a formula

object, using similar syntax to lme4 and brms,

such as outcome ~ time|individual_id/group_id. Verbally

this would be read as “outcome modeled by time accounting for

correlation between individual_id’s with fixed effects specified per

each group_id”. Note that this formula will not have to change for

different growth models, this is only to specify the structure of your

data. This simplification requires each of these parts of the formula

must be a single column in your dataframe. Note that for each group in

your data a set of parameters will be estimated. If you have lots of

groups in your data then it may make sense to fit models to only a few

groups at a time. If you do that then the models can still be compared

by extracting the MCMC draws, combining them into a dataframe, then

using brms::hypothesis per normal.

For model backends that do not account for autocorrelation the

individual will not be used and can be omitted leaving

outcome ~ time|group_id, but there is no harm in including

the individual_id component.

growthSS(..., sigma, ...)

The sigma argument controls distributional sub models.

This is only used with nlme and brms backends

which support different options.

In nlme models this models sigma and can be “int”,

“power”, or “exp” which correspond to using nlme::varIdent

(constant variance within groups), nlme::varPower (variance

changing by a power function), nlme::varExp (variance

changing by an exponential function).

In brms models this can be specified in the same way as

the general growth model and can be used to model any distributional

parameter in the model family you use. The default model family is

Student T, which has sigma and nu parameters. Other distributions can be

specified in the main growth model as

model = "family_name: model_name"

(model = "poisson: linear" as an example). For details on

available families see ?brms::brmsfamily. There is also an

“int” model type which fits a 0 slope intercept only model. While “int”

can be used in any brms model the option is meant to be

used specifying a homoskedastic sub model, or a period of noise before

the main growth trend begins (in terms of growth or variance).

Distributional parameters that are not specified will be modeled as

constant between groups.

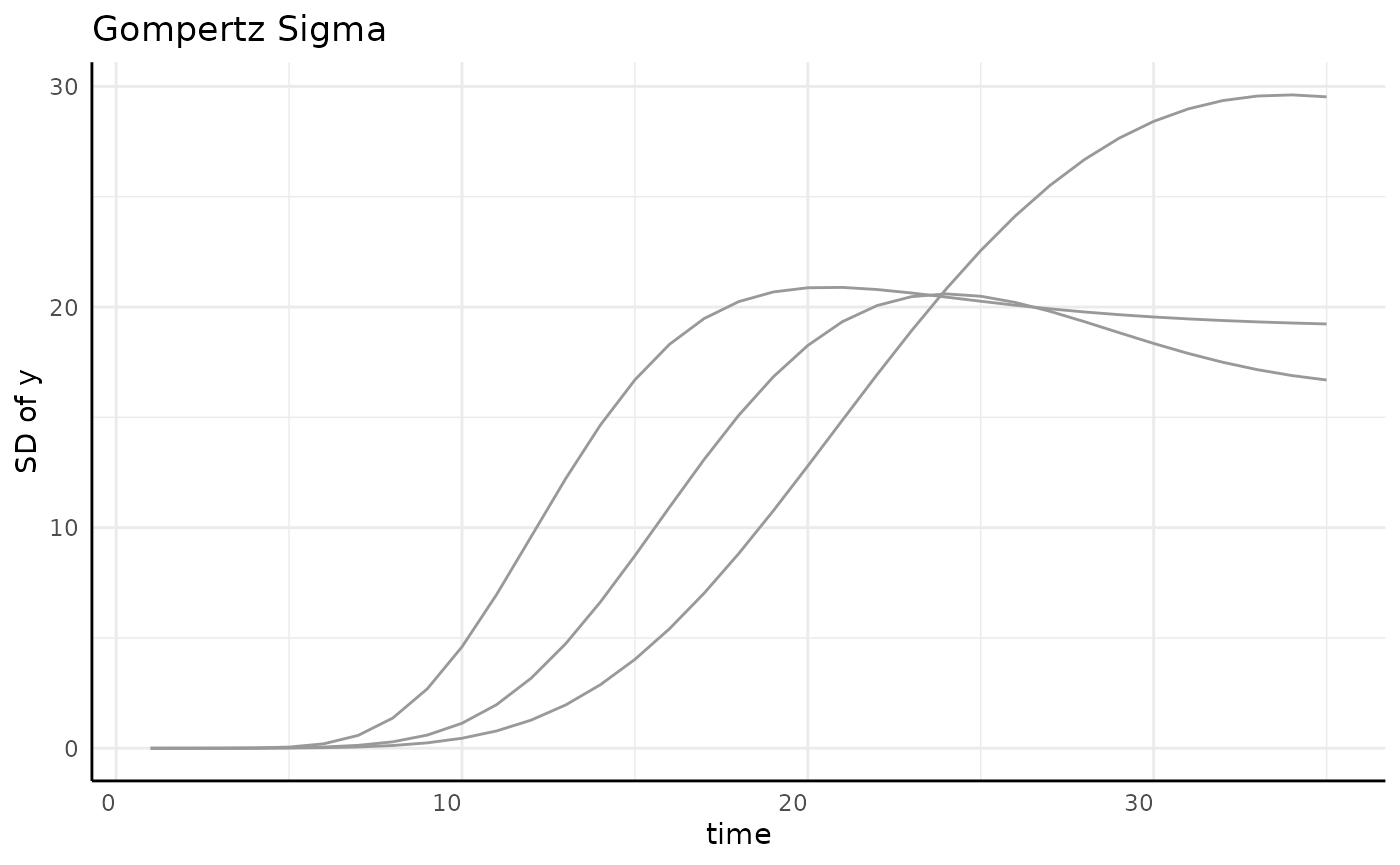

At a high level we can think about any of these models as fitting a curve to these lines.

set.seed(345)

gomp <- growthSim("gompertz", n = 20, t = 35, params = list(

"A" = c(200, 180, 160),

"B" = c(20, 22, 18),

"C" = c(0.15, 0.2, 0.1)

))

sigma_df <- aggregate(y ~ group + time, data = gomp, FUN = sd)

ggplot(sigma_df, aes(x = time, y = y, group = group)) +

geom_line(color = "gray60") +

pcv_theme() +

labs(y = "SD of y", title = "Gompertz Sigma")

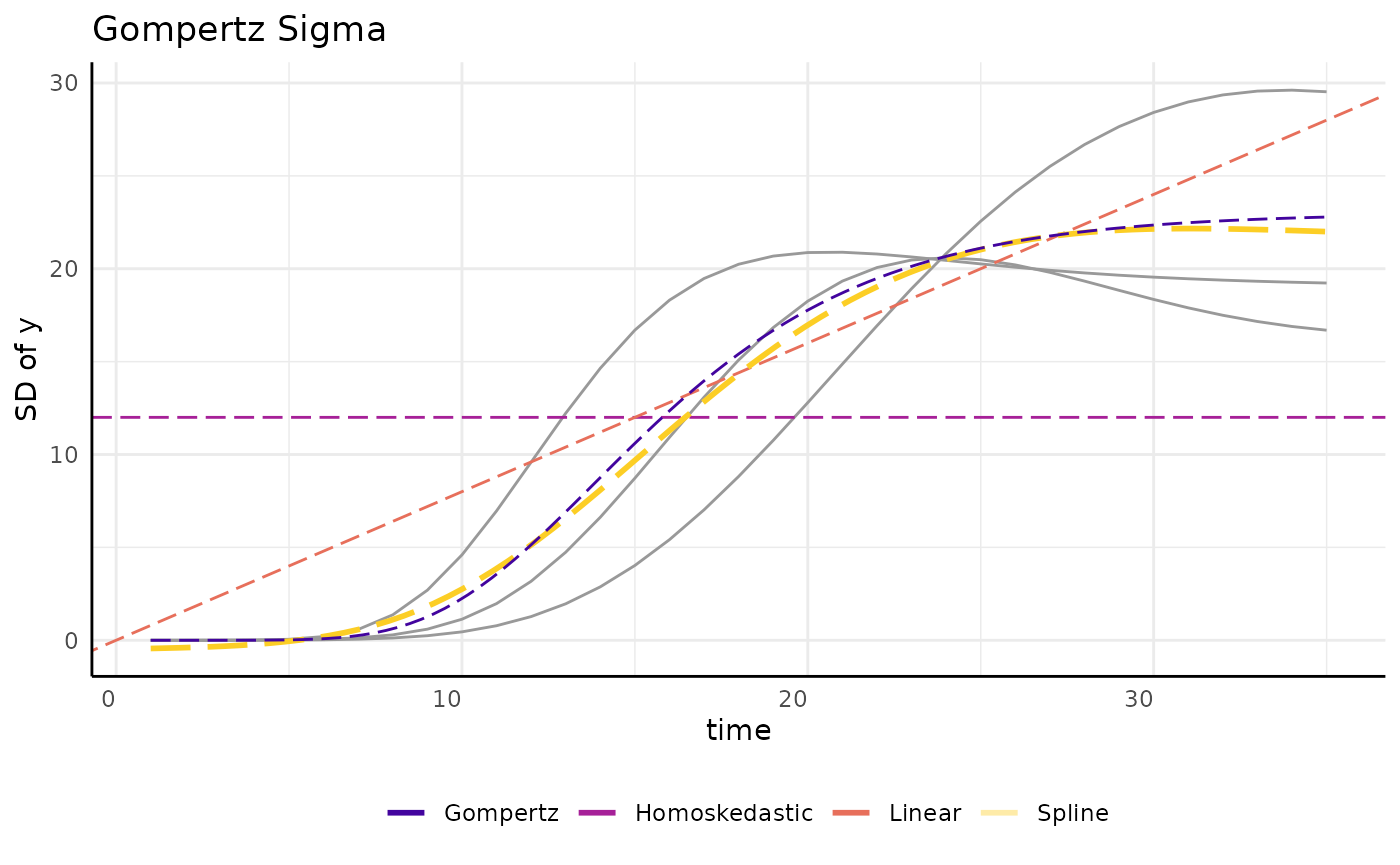

Several options are shown here, ignoring grouping here since the data is already aggregated.

draw_gomp_sigma <- function(x) {

return(23 * exp(-21 * exp(-0.22 * x)))

}

ggplot(sigma_df, aes(x = time, y = y)) +

geom_line(aes(group = group), color = "gray60") +

geom_hline(aes(yintercept = 12, color = "Homoskedastic"),

linetype = 5,

key_glyph = draw_key_path

) +

geom_abline(aes(slope = 0.8, intercept = 0, color = "Linear"),

linetype = 5,

key_glyph = draw_key_path

) +

geom_smooth(

method = "gam", aes(color = "Spline"), linetype = 5, se = FALSE,

key_glyph = draw_key_path

) +

geom_function(fun = draw_gomp_sigma, aes(color = "Gompertz"), linetype = 5) +

scale_color_viridis_d(option = "plasma", begin = 0.1, end = 0.9) +

guides(color = guide_legend(override.aes = list(linewidth = 1, linetype = 1))) +

pcv_theme() +

theme(legend.position = "bottom") +

labs(y = "SD of y", title = "Gompertz Sigma", color = "")

“int” will specify a homoskedastic model, that is one with constant variance over time per each group. While this is the default for almost every kind of statistical modeling it is an unrealistic assumption in this setting where we often follow growth from small seedlings to potentially fully grown plants. Even if we start with larger plants the homoskedastic assumption almost never holds in longitudinal modeling. We can fit an example model and see the issue with the homoskedastic assumption through the model’s credible intervals, which are far too wide at the beginning of the experiment and even include some negative values for plant area.

ss <- growthSS(

model = "gompertz", form = y ~ time | id / group, sigma = "int",

df = gomp, start = list("A" = 130, "B" = 15, "C" = 0.25)

)

ss## gompertz brms student model:

##

## pcvr formula variables:

## Outcome: y

## X: time

## Individual: id

## Group: group

##

## Model Formula:

## y ~ A * exp(-B * exp(-C * time))

## autocor ~ tructure(list(), class = "formula", .Environment = <environment>)

## sigma ~ 0 + group

## nu ~ 1

## A ~ 0 + group

## B ~ 0 + group

## C ~ 0 + group

##

## Data:

## id group time y

## 1 id_1 a 1 9.650345e-06

## 2 id_1 a 2 9.639086e-05

## 3 id_1 a 3 7.020911e-04

## ...

## (2100 rows)

fit_h <- fitGrowth(ss, iter = 1000, cores = 4, chains = 4, silent = 0)

brmPlot(fit_h, form = ss$pcvrForm, df = ss$df)We can relax this assumption and model sigma separately from the main

growth trend. To show an example of the options in pcvr,

here we repeat the example from above using a linear submodel. Note that

here we add some extra controls to the model fitting algorithm to help

the model fit well with the added complexity at the cost of being

slower.

ss <- growthSS(

model = "gompertz", form = y ~ time | id / group, sigma = "linear",

df = gomp, start = list("A" = 130, "B" = 15, "C" = 0.25)

)

ss## gompertz brms student model:

##

## pcvr formula variables:

## Outcome: y

## X: time

## Individual: id

## Group: group

##

## Model Formula:

## y ~ A * exp(-B * exp(-C * time))

## autocor ~ tructure(list(), class = "formula", .Environment = <environment>)

## sigma ~ time + time:group

## nu ~ 1

## A ~ 0 + group

## B ~ 0 + group

## C ~ 0 + group

##

## Data:

## id group time y

## 1 id_1 a 1 9.650345e-06

## 2 id_1 a 2 9.639086e-05

## 3 id_1 a 3 7.020911e-04

## ...

## (2100 rows)

fit_l <- fitGrowth(ss,

iter = 1000, cores = 4, chains = 4, silent = 0,

control = list(adapt_delta = 0.999, max_treedepth = 20)

)

p1 <- brmPlot(fit_l, form = ss$pcvrForm, df = ss$df)

p2 <- p1 + coord_cartesian(ylim = c(0, 300))

p <- p1 / p2

pThis model is also a poor fit, but it has a different problem. It accurately models the low variability at the beginning of the experiment, but the linear model is not flexible enough to adapt to the changes in variance even in this simulated data.

We can also use spline sub models. The spline model does a very good job of fitting the data due to the natural flexibility of polynomial functions. Again this added accuracy comes at the cost of taking longer for the model to fit. Here we can specify “gam” or “spline” for backwards compatibility.

ss <- growthSS(

model = "gompertz", form = y ~ time | id / group, sigma = "spline",

df = gomp, start = list("A" = 130, "B" = 15, "C" = 0.25)

)

ss## gompertz brms student model:

##

## pcvr formula variables:

## Outcome: y

## X: time

## Individual: id

## Group: group

##

## Model Formula:

## y ~ A * exp(-B * exp(-C * time))

## autocor ~ tructure(list(), class = "formula", .Environment = <environment>)

## sigma ~ s(time, by = group)

## nu ~ 1

## A ~ 0 + group

## B ~ 0 + group

## C ~ 0 + group

##

## Data:

## id group time y

## 1 id_1 a 1 9.650345e-06

## 2 id_1 a 2 9.639086e-05

## 3 id_1 a 3 7.020911e-04

## ...

## (2100 rows)

fit_s <- fitGrowth(ss,

iter = 2000, cores = 4, chains = 4, silent = 0,

control = list(adapt_delta = 0.999, max_treedepth = 20)

)

brmPlot(fit_s, form = ss$pcvrForm, df = ss$df)Here we try applying a gompertz function to the variance submodel. While this is much less flexible than splines it tends to describe the variance of a sigmoid growth model quite well and allows for easier hypothesis testing between groups. A fringe benefit can also be the predictability of the gompertz formula in extrapolating future data. Splines can have unexpected behavior when trying to predict timepoints outside of your initial data, but the gompertz formula is more predictable. Additionally, since the spline sub model will fit many basis functions this will generally be significantly faster since it only needs to find 3 parameters to complete the sub model, and each can have a mildly informative prior. As a single reference point, the model below fit in about 6 minutes while the spline model above took slightly over an hour to fit. These example models have three groups and the model with a gompertz sub model contains 21 total parameters while the spline sub model version contains 43 total parameters.

When setting priors for the gompertz sub-model it is generally reasonable to expect a similar growth rate and inflection point as in the main model (assuming the main model is gompertz as well).

ss <- growthSS(

model = "gompertz", form = y ~ time | id / group, sigma = "gompertz",

df = gomp, start = list(

"A" = 130, "B" = 15, "C" = 0.25,

"sigmaA" = 15, "sigmaB" = 15, "sigmaC" = 0.25

),

type = "brms"

)

ss## gompertz brms student model:

##

## pcvr formula variables:

## Outcome: y

## X: time

## Individual: id

## Group: group

##

## Model Formula:

## y ~ A * exp(-B * exp(-C * time))

## autocor ~ tructure(list(), class = "formula", .Environment = <environment>)

## sigma ~ sigmaA * exp(-sigmaB * exp(-sigmaC * time))

## nu ~ 1

## A ~ 0 + group

## B ~ 0 + group

## C ~ 0 + group

## sigmaA ~ 0 + group

## sigmaB ~ 0 + group

## sigmaC ~ 0 + group

##

## Data:

## id group time y

## 1 id_1 a 1 9.650345e-06

## 2 id_1 a 2 9.639086e-05

## 3 id_1 a 3 7.020911e-04

## ...

## (2100 rows)

fit_g <- fitGrowth(ss,

iter = 2000, cores = 4, chains = 4, silent = 0,

control = list(adapt_delta = 0.999, max_treedepth = 20)

)

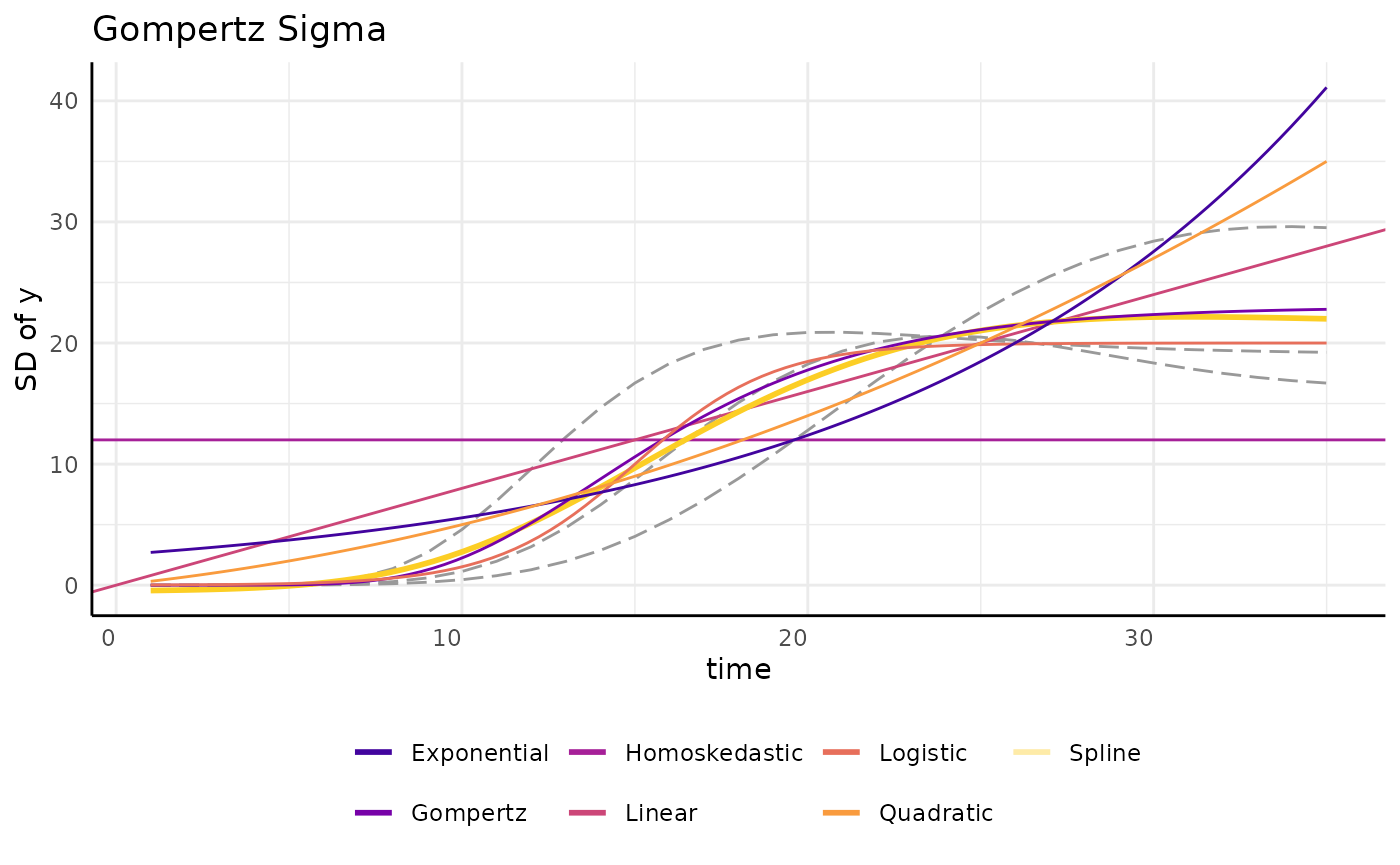

brmPlot(fit_g, form = ss$pcvrForm, df = ss$df)A few other options are shown here as further examples. There are as

many ways to model variance as there are to model growth using the

brms backend, but other options are more limited.

draw_gomp_sigma <- function(x) {

return(23 * exp(-21 * exp(-0.22 * x)))

}

draw_logistic_sigma <- function(x) {

return(20 / (1 + exp((15 - x) / 2)))

}

draw_logistic_exp <- function(x) {

return(2.5 * exp(0.08 * x))

}

draw_logistic_quad <- function(x) {

return((0.3 * x) + (0.02 * x^2))

}

ggplot(sigma_df, aes(x = time, y = y)) +

geom_line(aes(group = group), color = "gray60", linetype = 5) +

geom_hline(aes(yintercept = 12, color = "Homoskedastic"), linetype = 1) +

geom_abline(aes(slope = 0.8, intercept = 0, color = "Linear"),

linetype = 1,

key_glyph = draw_key_path

) +

geom_smooth(

method = "gam", aes(color = "Spline"), linetype = 1, se = FALSE,

key_glyph = draw_key_path

) +

geom_function(fun = draw_gomp_sigma, aes(color = "Gompertz"), linetype = 1) +

geom_function(fun = draw_logistic_sigma, aes(color = "Logistic"), linetype = 1) +

geom_function(fun = draw_logistic_exp, aes(color = "Exponential"), linetype = 1) +

geom_function(fun = draw_logistic_quad, aes(color = "Quadratic"), linetype = 1) +

scale_color_viridis_d(option = "plasma", begin = 0.1, end = 0.9) +

guides(color = guide_legend(override.aes = list(linewidth = 1, linetype = 1))) +

pcv_theme() +

theme(legend.position = "bottom") +

labs(y = "SD of y", title = "Gompertz Sigma", color = "")

When considering several sub models (or growth models) we can compare

brms models using Leave-One-Out Information Criterion (LOO

IC). For frequentist models a more familiar metric like BIC or AIC might

be used.

loo_spline <- add_criterion(fit_s, "loo")

loo_homo <- add_criterion(fit_h, "loo")

loo_linear <- add_criterion(fit_l, "loo")

loo_gomp <- add_criterion(fit_g, "loo")

h <- loo_homo$criteria$loo$estimates[3, 1]

s <- loo_spline$criteria$loo$estimates[3, 1]

l <- loo_linear$criteria$loo$estimates[3, 1]

g <- loo_gomp$criteria$loo$estimates[3, 1]

loodf <- data.frame(loo = c(h, s, l, g), model = c("Homosked", "Spline", "Linear", "Gompertz"))

loodf$model <- factor(loodf$model, levels = unique(loodf$model[order(loodf$loo)]), ordered = TRUE)

ggplot(

loodf,

aes(x = model, y = loo, fill = model)

) +

geom_col() +

scale_fill_viridis_d() +

labs(y = "LOO Information Criteria", x = "Sub Model of Sigma") +

theme_minimal() +

theme(legend.position = "none")The spline sub-model tends to have the best LOO IC, but comparing credible intervals while taking speed and interpretability into account may change which model is the best option for your situation. For this particular data the gompertz submodel does seem to perform very well despite the LOO IC difference from using splines.

growthSS(..., start, ...)

One of the main difficulties in non-linear modeling is getting the

models to fit without convergence errors. Using growthSS

the six main model options (and GAMs, although in a different way) are

self-starting and do not require starting values. For the double sigmoid

options starting values are required though.

Additionally, using the brms backend this argument is

used to specify prior distributions. Setting appropriate prior

distributions is an important part and often criticized part of Bayesian

statistics. Prior distributions are often talked about in the language

of “prior beliefs”, which can be somewhat misleading. Instead it can be

helpful to think of prior distributions as hard-headed prior

evidence.

In a broad sense, priors can be “strong” or “weak”.

Strong Priors

A strong prior is generally thought of as a prior with low variance. Almost all of the probability is in a tight space and the observed data will have a very hard time shifting the distribution meaningfully. Here is an example of a strong prior hurting a model. This example is clearly dramatic, but less absurd strong priors will still impact your results.

set.seed(345)

ln <- growthSim("linear", n = 5, t = 10, params = list("A" = c(2, 3, 10)))

strongPrior <- prior(student_t(3, 0, 5), dpar = "sigma", class = "b") +

prior(gamma(2, 0.1), class = "nu", lb = 0.001) +

prior(normal(10, .05), nlpar = "A", lb = 0)

ss <- growthSS(

model = "linear", form = y ~ time | id / group, sigma = "homo",

df = ln, priors = strongPrior

)

fit <- fitGrowth(ss, iter = 1000, cores = 2, chains = 2, silent = 0)

brmPlot(fit, form = ss$pcvrForm, df = ss$df) +

coord_cartesian(ylim = c(0, 100))Setting a prior as narrow as N(10, 0.05) intuitively

does feel too strong, as though we are so sure already that we can’t

expect to learn much more, but another way that a prior can be too

strong is in providing too much unrealistic information. Specifically

the flat prior can also be thought of as too strong given that it will

weigh all numbers equally, which is almost never a reasonable

assumption. In our growth model examples there should be no probability

given to negative growth rates when plants start from seed. Even if the

flat prior is constricted to be positive there is no parameterization

where a parameter value in the thousands or millions makes sense as

being biologically plausible.

Finally, when setting priors separately for groups you should consider the evidence toward your eventual hypotheses contained in those priors. If the mean effect size of some hypothesis of interest is far away from 0 based solely on your prior distributions then they are probably too strong.

Above all, remember to focus on evidence instead of hopes and

beliefs. By default pcvr will make biologically plausible

and individually weak priors for each parameter in your growth model

using growthSS and check that the prior evidence of common

hypotheses is not too strong, but it will not stop you from going

forward with strong priors if you specify them.

Weak Prior

Generally we aim for “weak” or “mildly informative” priors. The goal with these is to constrict our sampler to possible values so that it moves faster and to introduce evidence driven domain expertise.

weakPrior <- prior(student_t(3, 0, 5), dpar = "sigma", class = "b") +

prior(gamma(2, 0.1), class = "nu", lb = 0.001) +

prior(lognormal(log(10), 0.25), nlpar = "A", lb = 0)

ss <- growthSS(

model = "linear", form = y ~ time | id / group, sigma = "homo",

df = ln, priors = weakPrior

)

fit <- fitGrowth(ss, iter = 1000, cores = 2, chains = 2, silent = 0)

brmPlot(fit, form = ss$pcvrForm, df = ss$df) +

coord_cartesian(ylim = c(0, 100))As you can see the weak priors moved to meet our data and now we have usable posterior distributions. The variance is large but that is natural with 5 reps per condition when looking at 99% credible intervals.

Priors in growthSS

In growthSS priors can be specified as a

brmsprior object (in which case it is used as is, like in

the strong/weak examples above), a named list (names representing

parameters), or a numeric vector, where values will be used to generate

lognormal priors with a long right tail. Lognormal priors with long

right tails are used because the values for our growth curves are

strictly positive and the lognormal distribution is easily interpreted.

The tail is a product of the variance, which is assumed to be 0.25 for

simplicity and to ensure priors are wide. This means that only a

location parameter needs to be provided. If a list is used then each

element of the list can be length 1 in which case each group will use

the same prior or it can be a vector of the same length as

unique(data$group) where group is your

grouping variable from the form argument to

growthSS. If a vector is used then a warning will be

printed to check that the assumed order of groups is correct. The

growthSim function can be useful in thinking about what a

reasonable prior distribution might be, although priors should not be

picked by trying to get a great fit by eye to your collected data.

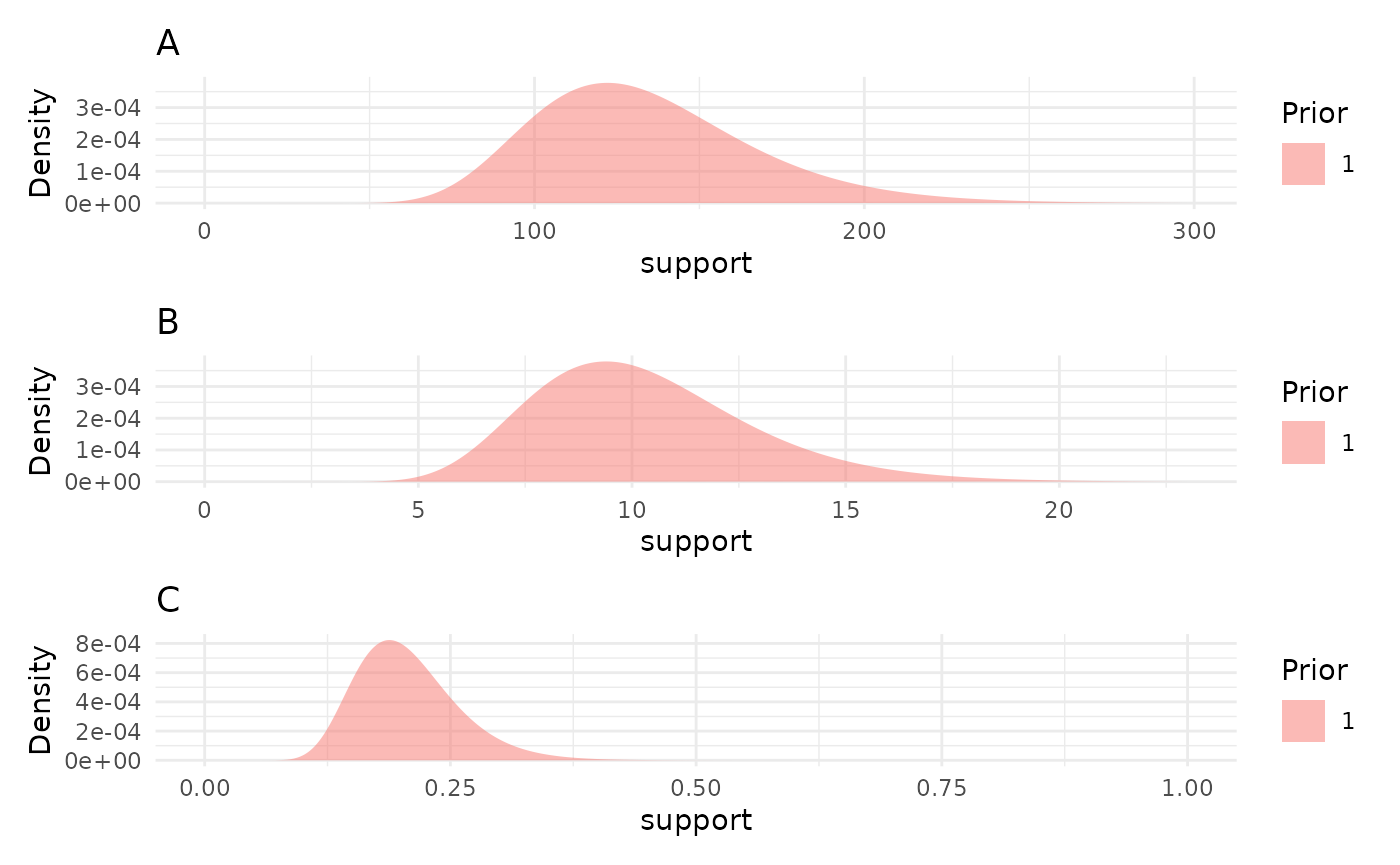

We can check the priors made by growthSS with the

plotPrior function.

priors <- list("A" = 130, "B" = 10, "C" = 0.2)

priorPlots <- plotPrior(priors)

priorPlots[[1]] / priorPlots[[2]] / priorPlots[[3]]

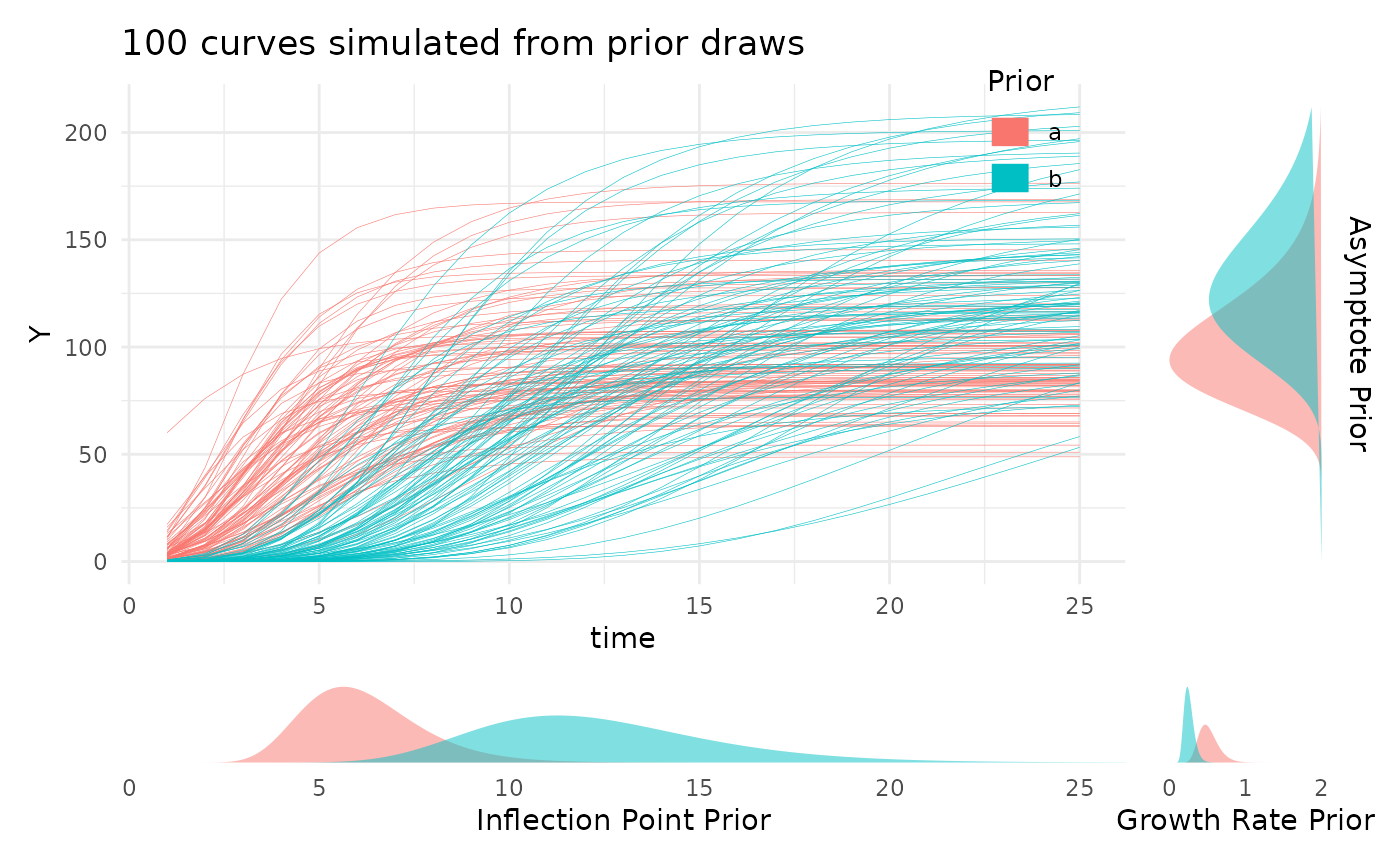

Looking at the prior distributions this way is useful, but the

parameter values can be a degree removed from what we are really wanting

to check. To help with picking reasonable priors based on the growth

curves they’d represent the plotPrior function can also

simulate growth curves by making draws from the specified prior

distributions. Here is an example of using plotPrior in

this way to pick between possible sets of prior distributions for a

gompertz model. For asymptotic distributions the prior on “A” is added

to the y margin. For distributions with an inflection point the prior on

“B” is shown in the x margin. Arbitrary numbers of priors can be

compared in this manner, but more than two or three can be cluttered so

an iterative process is recommended if you are learning about your

growth model.

twoPriors <- list("A" = c(100, 130), "B" = c(6, 12), "C" = c(0.5, 0.25))

plotPrior(twoPriors, "gompertz", n = 100)[[1]]

growthSS(..., tau, ...)

For nlrq models the “tau” argument determines which

quantiles are fit. By default this uses the median (0.5), but can be any

quantile or vector of quantiles between 0 and 1. In the next section we

fit an nlrq model with many quantiles shown.

growthSS(..., hierarchy, ...)

Hierarchical models can be specified by adding covariates to the

model formula and specifying models for those covariates in the

hierarchy argument.

A hierarchical formula would be written as

y ~ time + covar | id / group and we could specify to only

model the A parameter as being modeled by

covar by adding

hierarchy = list("A" = "int_linear").

This would change a logistic model from something like:

$$ Y \sim \frac{A}{(1 + \text{e}^{( (B-x)/C)})}\\ A \sim 0 + \text{group}\\ B \sim 0 + \text{group}\\ C \sim 0 + \text{group} $$

to being something like:

$$ Y \sim \frac{A}{(1 + \text{e}^{( (B-x)/C)})}\\ A \sim AI + AA \cdot \text{covariate}\\ B \sim 0 + \text{group}\\ C \sim 0 + \text{group}\\ AI \sim 0 + \text{group}\\ AA \sim 0 + \text{group} $$

This can be helpful in modeling the effect of time on one phenotype given another or in including watering data, etc.

Multi Value Traits

Multi value traits can be modeled in the same ways using the

mvSS function.

For the most part mvSS has the same arguments as

growthSS but with the addition of a

spectral_index argument, which can be “none” or any of the

indices listed in the PlantCV docs.

If a spectral index is specified then any truncation of the response

variable is handled for you and the model family is changed to

skew_normal (if using the brms backend).

Additionally, since there are generally fewer options for working

with multi value traits the mvSS function can use

non-longitudinal data, as in the example below, where the formula

specifies bins given value per bin predicted

by group.

set.seed(123)

mv_df <- mvSim(dists = list(rnorm = list(mean = 100, sd = 30)), wide = FALSE)

mv_df$group <- rep(c("a", "b"), times = 900)

mv_df <- mv_df[mv_df$value > 0, ]

mv_df$label <- as.numeric(gsub("sim_", "", mv_df$variable))

ss1 <- mvSS(

model = "linear", form = label | value ~ group, df = mv_df,

start = list("A" = 5), type = "brms", spectral_index = "ci_rededge"

)

ss1## linear brms skew_normal model:

##

## pcvr formula variables:

## Outcome: label | resp_weights(value) + trunc(lb = -1, ub = Inf)

## Group: group

##

## Model Formula:

## label | resp_weights(value) + trunc(lb = -1, ub = Inf) ~ A

## A ~ 0 + group

##

## Data:

## id group variable value label

## 7 7 a sim_1 2 1

## 8 8 b sim_1 1 1

## 9 9 a sim_1 1 1

## ...

## (1454 rows)Using fitGrowth

The output from growthSS is passed to

fitGrowth which fits the growth model using the specified

backend.

Here we fit a model using each backend to simulated data.

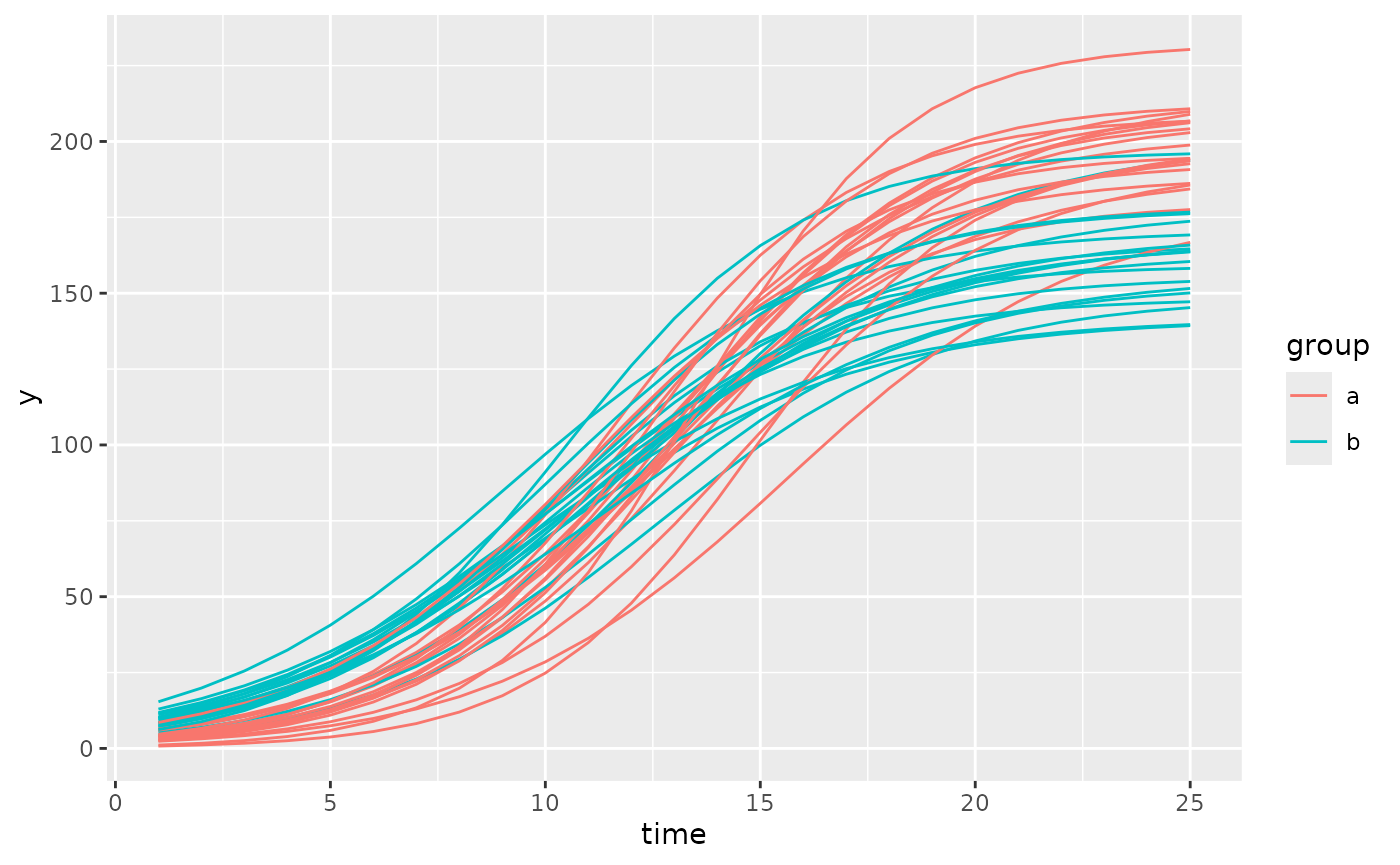

set.seed(123)

simdf <- growthSim("logistic", n = 20, t = 25, params = list(

"A" = c(200, 160),

"B" = c(13, 11),

"C" = c(3, 3.5)

))

nls_ss <- growthSS(

model = "logistic", form = y ~ time | id / group,

df = simdf, type = "nls"

)## Individual is not used with type = 'nls'.

nlrq_ss <- growthSS(

model = "logistic", form = y ~ time | id / group,

df = simdf, type = "nlrq",

tau = seq(0.01, 0.99, 0.04)

)## Individual is not used with type = 'nlrq'.

nlme_ss <- growthSS(

model = "logistic", form = y ~ time | id / group,

df = simdf, sigma = "power", type = "nlme"

)

mgcv_ss <- growthSS(

model = "gam", form = y ~ time | id / group,

df = simdf, type = "mgcv"

)## Individual is not used with type = 'gam'.

brms_ss <- growthSS(

model = "logistic", form = y ~ time | id / group,

sigma = "spline", df = simdf,

start = list("A" = 130, "B" = 10, "C" = 1)

)Now we have all the essential model components in the

..._ss objects. Since we specified a logistic model we have

three parameters, the asymptote (A), the inflection point

(B), and the growth rate (C). In the

brms option our sub model uses a GAM and does not add more

parameters. Note that in practice gompertz models tend to fit real data

better than logistic models, but they can be more difficult to fit using

the frequentist backends.

Before trying to fit the model it is generally a good idea to check one last plot of the data and make sure you have everything defined correctly.

ggplot(simdf, aes(time, y, group = interaction(group, id))) +

geom_line(aes(color = group))

This looks okay, there are no strange jumps in the data or glaring problems, the group and id variables seem to uniquely identify lines so the models should fit well.

Now we use fitGrowth to fit our models. Additional

arguments can be passed to fitGrowth (see ?fitGrowth for

details), but here we only use those to specify details for the

brms model. Note that 500 iterations for the

brms model is only to run a quick example, generally 2000

or more should be used and with more than 1 chain.

nls_fit <- fitGrowth(nls_ss)

nlrq_fit <- fitGrowth(nlrq_ss)

nlme_fit <- fitGrowth(nlme_ss)

mgcv_fit <- fitGrowth(mgcv_ss)

brms_fit <- fitGrowth(brms_ss,

iter = 500, cores = 1, chains = 1,

control = list(adapt_delta = 0.999, max_treedepth = 20)

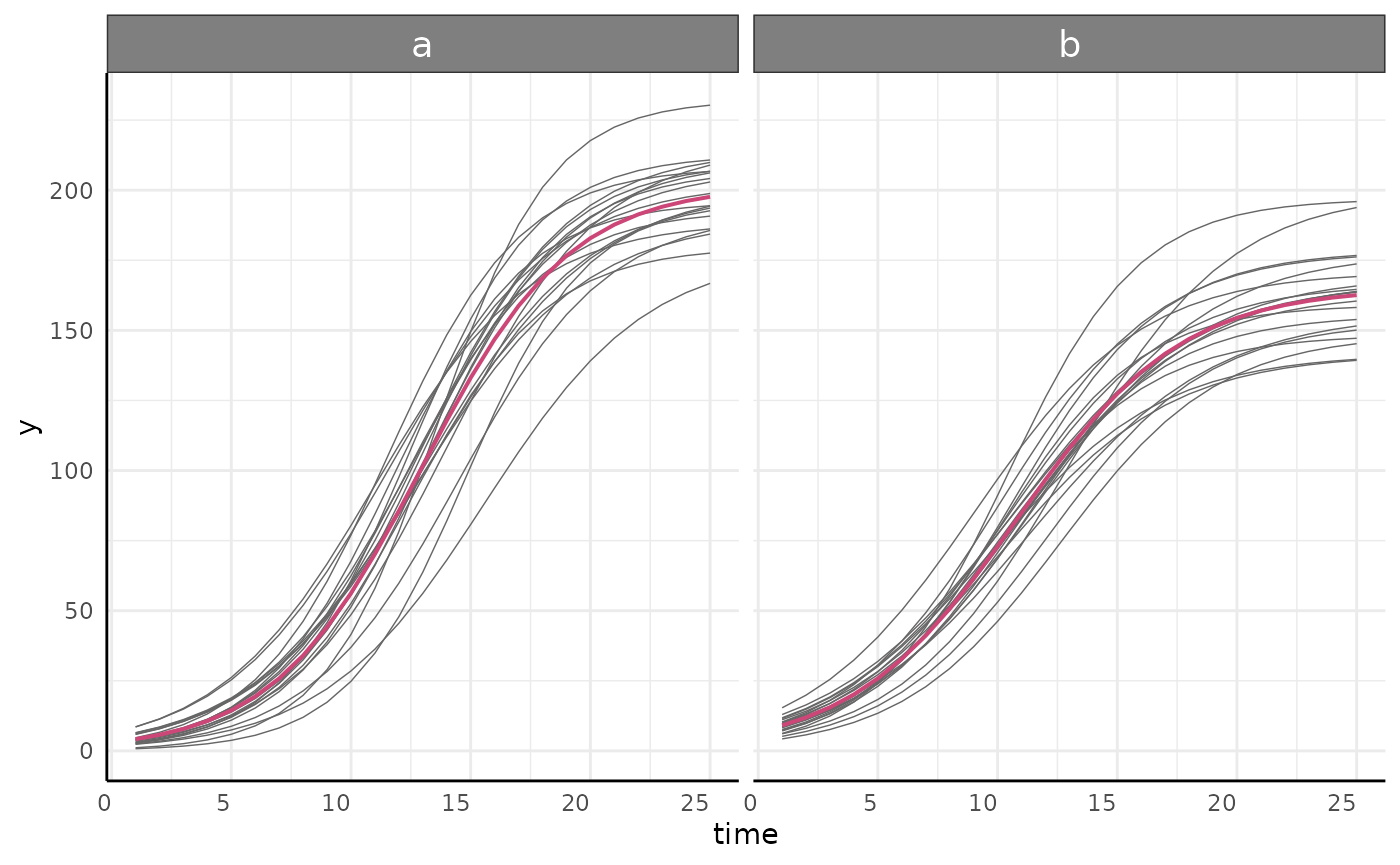

)Check Model Fit

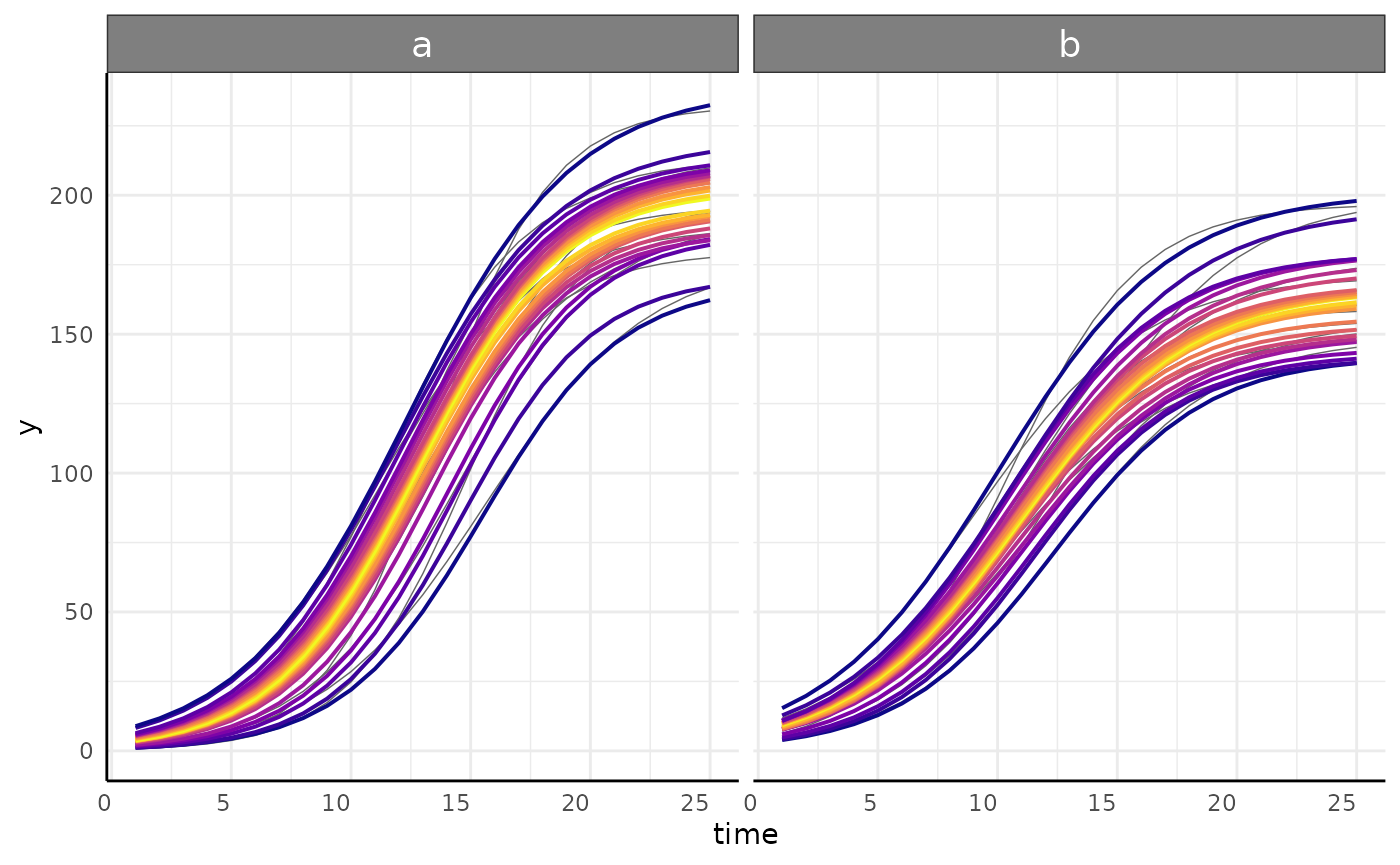

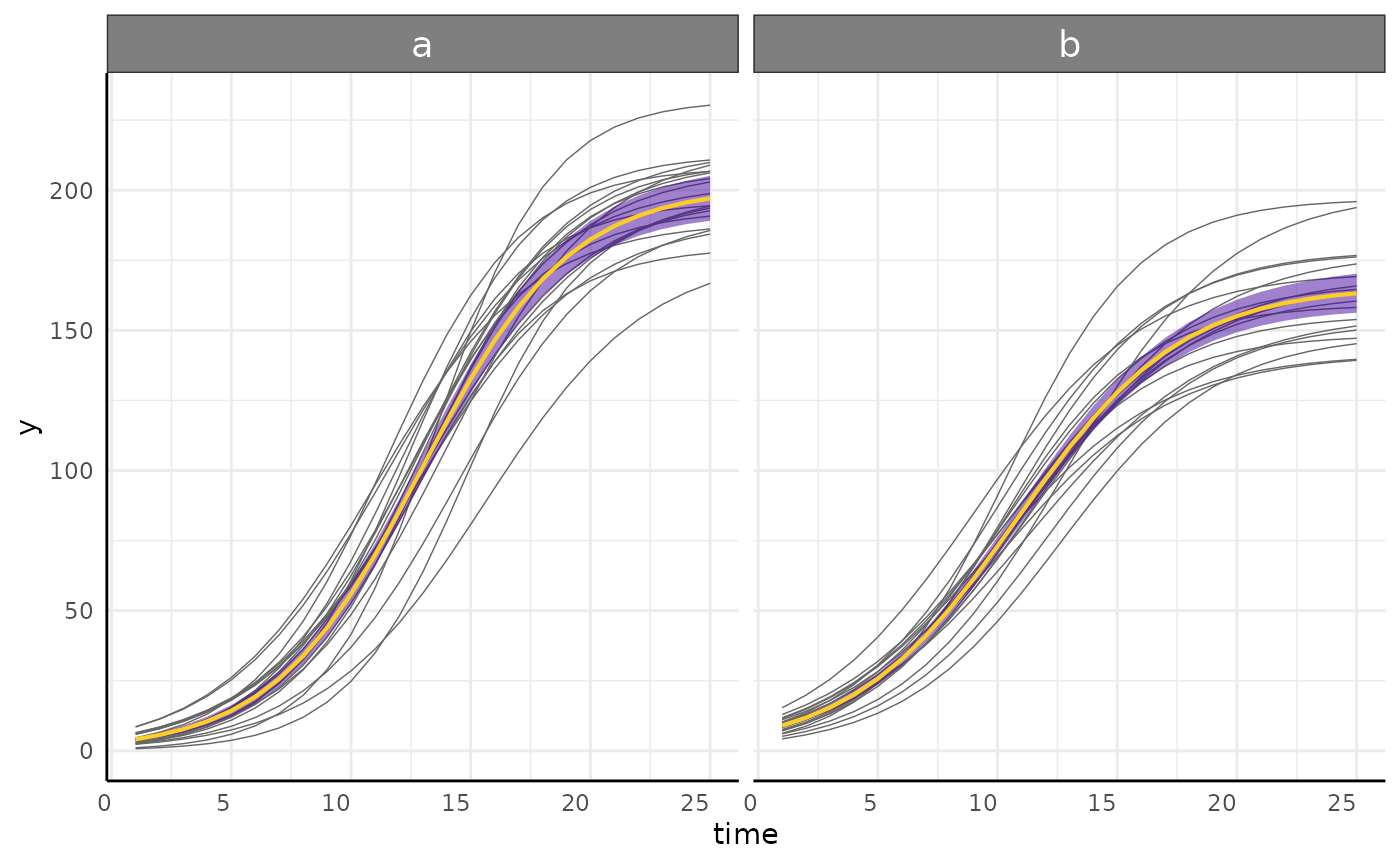

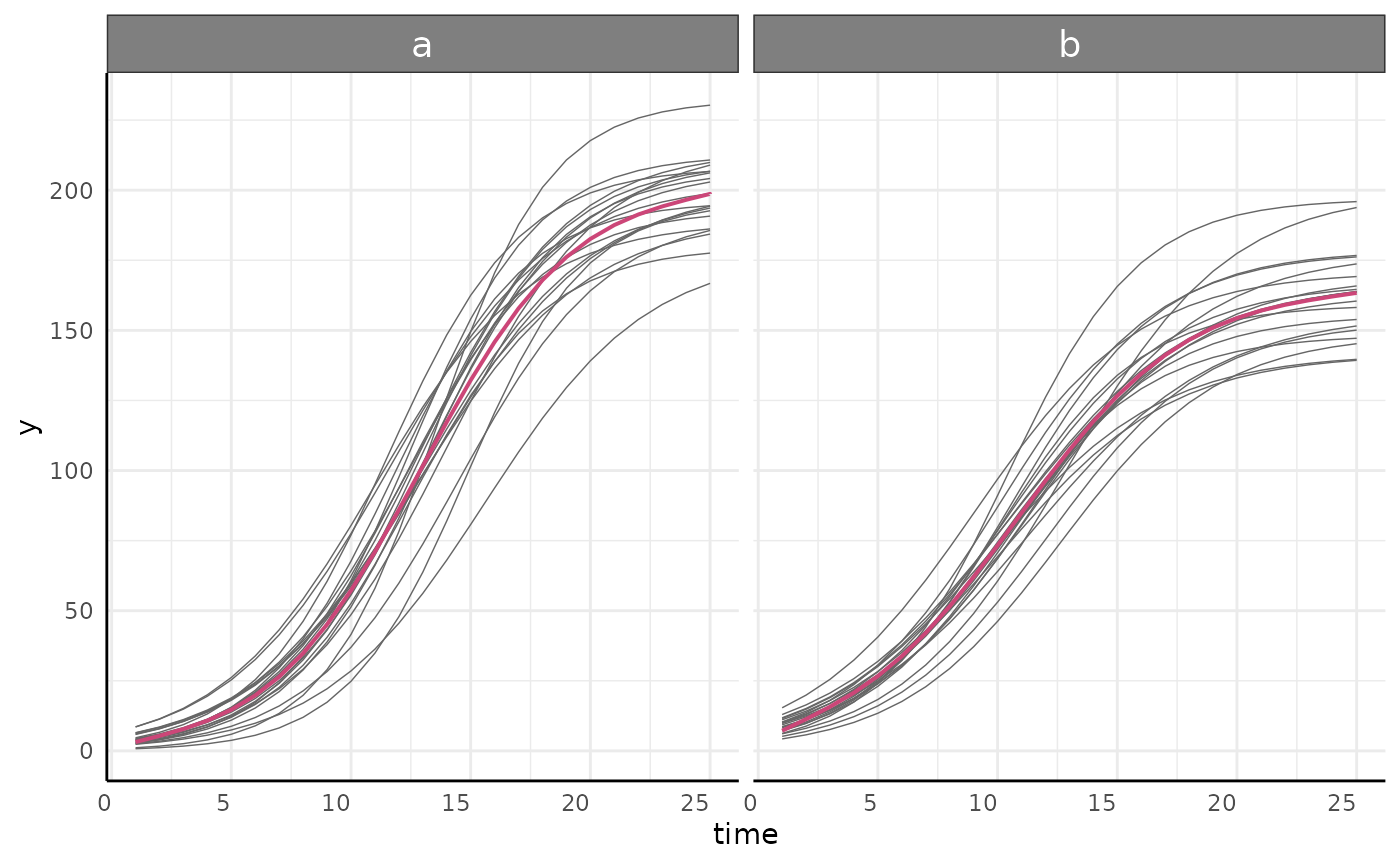

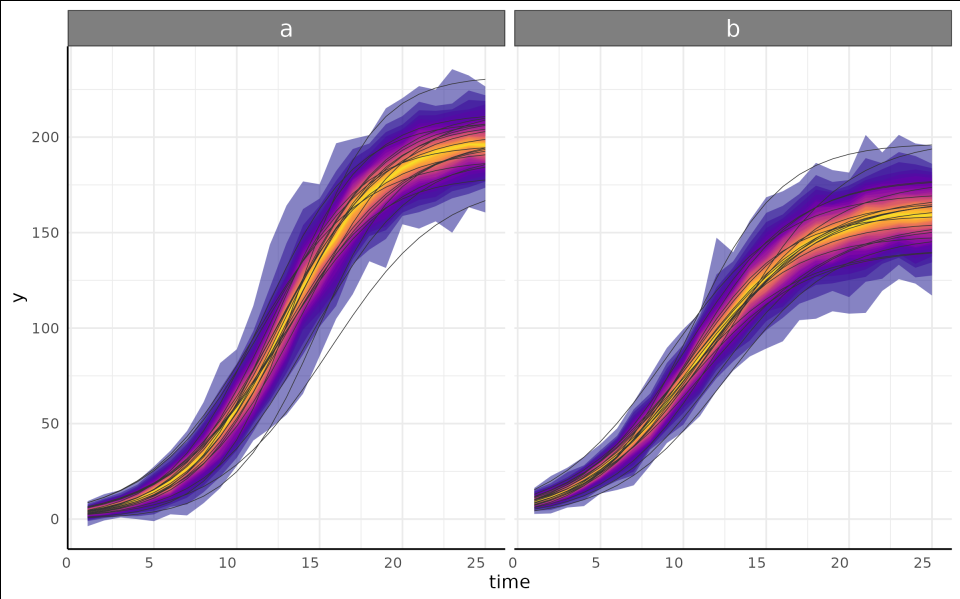

We can check the model fits using growthPlot.

growthPlot(nls_fit, form = nls_ss$pcvrForm, df = nls_ss$df)

growthPlot(nlrq_fit, form = nlrq_ss$pcvrForm, df = nlrq_ss$df)

growthPlot(nlme_fit, form = nlme_ss$pcvrForm, df = nlme_ss$df)

growthPlot(mgcv_fit, form = mgcv_ss$pcvrForm, df = mgcv_ss$df)

growthPlot(brms_fit, form = brms_ss$pcvrForm, df = brms_ss$df)

Hypothesis testing

In linear regression the default null hypothesis

()

can be useful as each beta past the intercept directly measures the

effect of one variable. In non-linear regression we generally have more

complicated model parameters and meaningful testing can be a little more

involved, typically requiring contrast statements or nested models. In

pcvr the testGrowth function allows for

hypothesis testing on model parameters for frequentist models. For

Bayesian models the brms::hypothesis function is

recommended.

testGrowth

testGrowth takes three arguments, the

growthSS output used to fit a model, the model itself, and

a list of parameters to test. Broadly, two kinds of tests are supported.

First, if the test argument is a parameter name or a vector

of parameter names then a version of the model is fit with the

parameters in test not varying by group and the models are

compared with an anova. In this case the resulting p-value is broadly

testing the null hypothesis that the groups have the same value for that

parameter.

Here we see that for our nls model is statistically

significantly improved by varying asymptote by group.

testGrowth(nls_ss, nls_fit, test = "A")$anova## Analysis of Variance Table

##

## Model 1: y ~ A/(1 + exp((B[group] - time)/C[group]))

## Model 2: y ~ A[group]/(1 + exp((B[group] - time)/C[group]))

## Res.Df Res.Sum Sq Df Sum Sq F value Pr(>F)

## 1 995 204775

## 2 994 171686 1 33089 191.57 < 2.2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Likewise for the 49th percentile in our nlrq model

testGrowth(nlrq_ss, nlrq_fit, test = "A")[["0.49"]]## Model 1: y ~ A[group]/(1 + exp((B[group] - time)/C[group]))

## Model 2: y ~ A/(1 + exp((B[group] - time)/C[group]))

## #Df LogLik Df Chisq Pr(>Chisq)

## 1 6 -3901.2

## 2 5 -4029.8 -1 257.27 < 2.2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1And the same is shown in our nlme model.

testGrowth(nlme_ss, nlme_fit, test = "A")$anova## Model df AIC BIC logLik Test L.Ratio p-value

## nullMod 1 13 4923.097 4986.898 -2448.549

## fit 2 16 4913.518 4992.042 -2440.759 1 vs 2 15.57969 0.0014We cannot test parameters in the GAM of course but we still see that the grouping improves the model fit.

testGrowth(mgcv_ss, mgcv_fit)$anova## Analysis of Deviance Table

##

## Model 1: y ~ s(time)

## Model 2: y ~ 0 + group + s(time, by = group)

## Resid. Df Resid. Dev Df Deviance F Pr(>F)

## 1 992.43 271044

## 2 985.06 172134 7.3716 98909 76.96 < 2.2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1These are relatively basic options for testing hypotheses in non-linear growth models and should serve as a good starting point for frequentist model analysis.

The second kind of hypothesis test in testGrowth is used

if the test argument is a hypothesis or list of hypotheses

similar to those used in brms::hypothesis syntax. These can

test more complex non-linear hypotheses by using

car::deltaMethod to calculate standard errors for model

parameters. Note that this kind of testing is only supported with

nls and nlme model backends. This is a much

more flexible testing option.

Here we test several hypotheses on our nls and

nlme models to show the versatility of this option. In

practice you should not use these hypotheses and should be giving some

thought to how to express your stated hypothesis in terms of the model

parameters.

testGrowth(fit = nls_fit, test = list(

"A1 - A2 *1.1",

"(B1+1) - B2",

"C1 - (C2-0.5)",

"A1/B1 - (1.1 * A2/B2)"

))## Form Estimate SE t-value p-value

## 1 A1 - A2 *1.1 19.9337491 2.5232917 7.899899 7.368006e-15

## 2 (B1+1) - B2 3.1348883 0.1624348 19.299359 9.834927e-71

## 3 C1 - (C2-0.5) 0.1517508 0.1292836 1.173782 2.407636e-01

## 4 A1/B1 - (1.1 * A2/B2) -1.2329672 0.1538017 8.016603 3.036364e-15

testGrowth(fit = nlme_fit, test = list(

"(A.groupa / A.groupb) - 0.9",

"1 + (B.groupa - B.groupb)",

"C.groupa/C.groupb - 1"

))## Form Estimate SE Z-value p-value

## 1 (A.groupa / A.groupb) - 0.9 0.3122201 0.03541827 8.815227 1.194428e-18

## 2 1 + (B.groupa - B.groupb) 3.1217631 0.16951043 18.416348 9.714055e-76

## 3 C.groupa/C.groupb - 1 -0.1002474 0.03665858 2.734623 6.245172e-03

brms::hypothesis

With the brms backend our options expand dramatically.

We can write arbitrarily complex hypotheses about our models and test

the posterior probability using brms::hypothesis. Here we

keep it simple and test that group A has an asymptote 10% larger than

group B’s asymptote. If we had a more complicated dataset then there is

no reason we could not expand this hypothesis instead to something like

((A_genotype1_treatment1/A_genotype1_treatment2))-(1.1*(A_genotype2_treatment1/A_genotype2_treatment2)) > 0

to test relative tolerance to different treatments between genotypes. It

would be out of scope to go over all the potentially interesting

hypotheses since those will depend on your experimental design and

questions, but hopefully this communicates the flexibility in using

these models once they are fit. Access to the

brms::hypothesis function is generally a compelling reason

to use the brms backend if you have questions beyond “are

these groups different?”

(hyp <- brms::hypothesis(brms_fit, "(A_groupa) > 1.1 * (A_groupb)"))## Hypothesis Estimate Est.Error CI.Lower CI.Upper

## 1 ((A_groupa))-(1.1*(A_groupb)) > 0 16.78802 3.135185 12.01271 21.9525

## Evid.Ratio Post.Prob Star

## 1 Inf 1 *Threshold Models

As alluded to previously, using the brms backend

segmented models are possible and can be specified using “model1 +

model2” syntax, where the “+” specifies a changepoint where the process

shifts from model1 to model2. As many models as you need to combine can

be combined in this way, but more than 2 segments is likely to be very

slow and can become more difficult to fit well. If you add many segments

together then consider editing the growthSS output to set

stronger priors on any changepoints that are in the same vicinity. Since

the changepoints are parameterized they require priors and can be

included in any hypothesis tests on the model.

Here we briefly show several threshold model options.

First we look at a “linear + linear” model using a gam submodel. To make the parameters distinct these segmented models have slightly different parameter names. Each section of the model has parameters named for the model and it’s parameters, so here we have “linear1A”, “changePoint1”, and “linear2A”. Similar to the standard models, a changepoint model of variance will have the name of the distributional parameter they are modeling appended to each parameter name.

simdf <- growthSim(

model = "linear + linear",

n = 20, t = 25,

params = list("linear1A" = c(15, 12), "changePoint1" = c(8, 6), "linear2A" = c(3, 5))

)

ss <- growthSS(

model = "linear + linear", form = y ~ time | id / group, sigma = "spline",

start = list("linear1A" = 10, "changePoint1" = 5, "linear2A" = 2),

df = simdf, type = "brms"

)

fit <- fitGrowth(ss, backend = "cmdstanr", iter = 500, chains = 1, cores = 1)Here we look at a “linear + logistic” model using a gam submodel.

simdf <- growthSim("linear + logistic",

n = 20, t = 25,

params = list(

"linear1A" = c(15, 12), "changePoint1" = c(8, 6),

"logistic2A" = c(100, 150), "logistic2B" = c(10, 8),

"logistic2C" = c(3, 2.5)

)

)

ss <- growthSS(

model = "linear + logistic", form = y ~ time | id / group, sigma = "spline",

list(

"linear1A" = 10, "changePoint1" = 5,

"logistic2A" = 100, "logistic2B" = 10, "logistic2C" = 3

),

df = simdf, type = "brms"

)

fit <- fitGrowth(ss, backend = "cmdstanr", iter = 500, chains = 1, cores = 1)Here we fit a “linear + gam” model with a homoskedastic sub model.

ss <- growthSS(

model = "linear + gam", form = y ~ time | id / group, sigma = "int",

list("linear1A" = 10, "changePoint1" = 5),

df = simdf, type = "brms"

)

fit <- fitGrowth(ss, backend = "cmdstanr", iter = 500, chains = 1, cores = 1)Here we fit a three part linear model with a gam to model variance. In this case we only used 500 iterations on one chain but the model still fits reasonably well.

simdf <- growthSim("linear + linear + linear",

n = 25, t = 50,

params = list(

"linear1A" = c(10, 12), "changePoint1" = c(8, 6),

"linear2A" = c(1, 2), "changePoint2" = c(25, 30), "linear3A" = c(20, 24)

)

)

ss <- growthSS(

model = "linear + linear + linear", form = y ~ time | id / group, sigma = "spline",

list(

"linear1A" = 10, "changePoint1" = 5,

"linear2A" = 2, "changePoint2" = 15,

"linear3A" = 5

), df = simdf, type = "brms"

)

fit <- fitGrowth(ss, backend = "cmdstanr", iter = 500, chains = 1, cores = 1)We can also fit thresholded models to the variance. Here we fit two part intercept only models to both the data and the variance. This is not a growth model exactly, but shows some of the available options well.

ss <- growthSS(

model = "int + int", form = y ~ time | id / group, sigma = "int + int",

list(

"int1" = 10, "changePoint1" = 10, "int2" = 20, # main model

"sigmaint1" = 10, "sigmachangePoint1" = 10, "sigmaint2" = 10

), # sub model

df = simdf, type = "brms"

)

fit <- fitGrowth(ss, backend = "cmdstanr", iter = 500, chains = 1, cores = 1)Here we fit int + linear models to the overall trend and the variance

ss <- growthSS(

model = "int + linear", form = y ~ time | id / group, sigma = "int + linear",

list(

"int1" = 10, "changePoint1" = 10, "linear2A" = 20,

"sigmaint1" = 10, "sigmachangePoint1" = 10, "sigmalinear2A" = 10

),

df = simdf, type = "brms"

)

fit <- fitGrowth(ss, backend = "cmdstanr", iter = 500, chains = 1, cores = 1)Finally we fit a model of “int + logistic” for the main growth trend and “int + gam” for the variance. The benefit here over a pure “gam” model of variance is that we can test the intercept and changepoint parameters of the variance now.

ss <- growthSS(

model = "int+logistic", form = y ~ time | id / group, sigma = "int + spline",

list(

"int1" = 5, "changePoint1" = 10,

"logistic2A" = 130, "logistic2B" = 10, "logistic2C" = 3,

"sigmaint1" = 5, "sigmachangePoint1" = 15

),

df = simdf, type = "brms"

)

fit <- fitGrowth(ss, backend = "cmdstanr", iter = 500, chains = 1, cores = 1)Bayesian Analysis and Reporting Guidelines

Bayesian modeling offers a lot of flexibility but it is in less

common use than frequentist statistics so it can be more difficult to

explain to collaborators or reviewers. Additionally, guaranteeing

reproducibility and transparency requires some different steps. To help

with these (and other) potential issues John Kruschke wrote a paper on

the Bayesian

Analysis and Reporting Guidelines (BARG). All the information

required to fully explain a Bayesian model is returned by

Stan and by brms, but for ease of use pcvr has

a barg function that takes the fit model object and the

growthSS output to return several components of the BARG

useful for checking one or more models. See the documentation

(?barg) for more details.

Comparing Models Over Time

As a final note on brms models, there is a possiblity of

making interesting early stopping rules in a Bayesian framework. If you

have models fit to subsets of your data then the distPlot

function will show changes in the posterior distribution for some or all

of your parameters over time or over another subset variable. Here the

growth trend plots are also a legend for the time of each posterior

distribution.

print(load(url("https://raw.githubusercontent.com/joshqsumner/pcvrTestData/main/brmsFits.rdata")))

from3to25 <- list(

fit_3, fit_5, fit_7, fit_9, fit_11, fit_13,

fit_15, fit_17, fit_19, fit_21, fit_23, fit_25

)

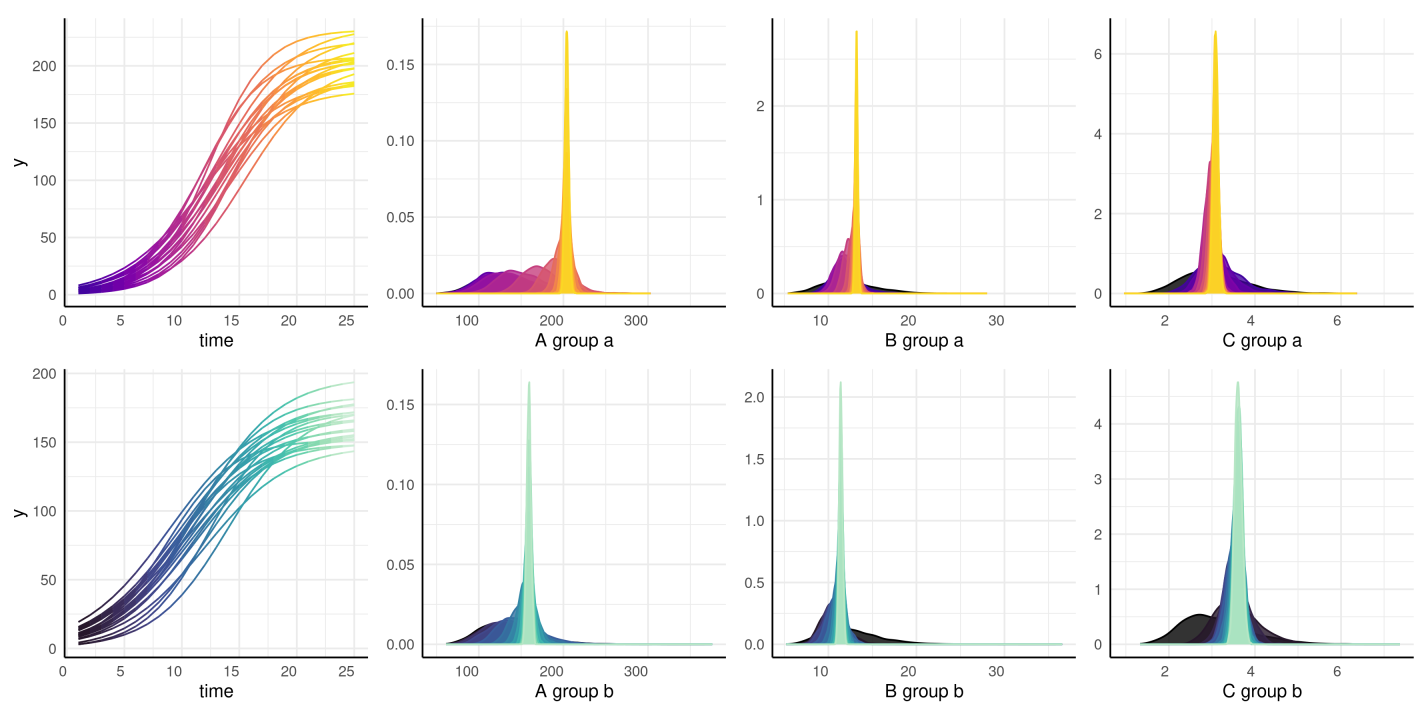

distributionPlot(fits = from3to25, form = y ~ time | id / group, params = c("A", "B", "C"), d = simdf)

Other Resources

The supported models in pcvr are meant to lower the

barrier to entry for complex models using brms and

Stan. While there are lots of options using these growth

models there are many many more options using brms directly

and still more is possible programming directly in Stan. If

you take an interest in developing more and more nuanced models then

please see the brms

documentation, Stan

documentation, or stan

forums. For models that you think may have broader appeal for high

throughput plant phenotyping please raise an issue on github and help the

DDPSC data science team understand what the desired model is/where

existing options fall short for your needs.